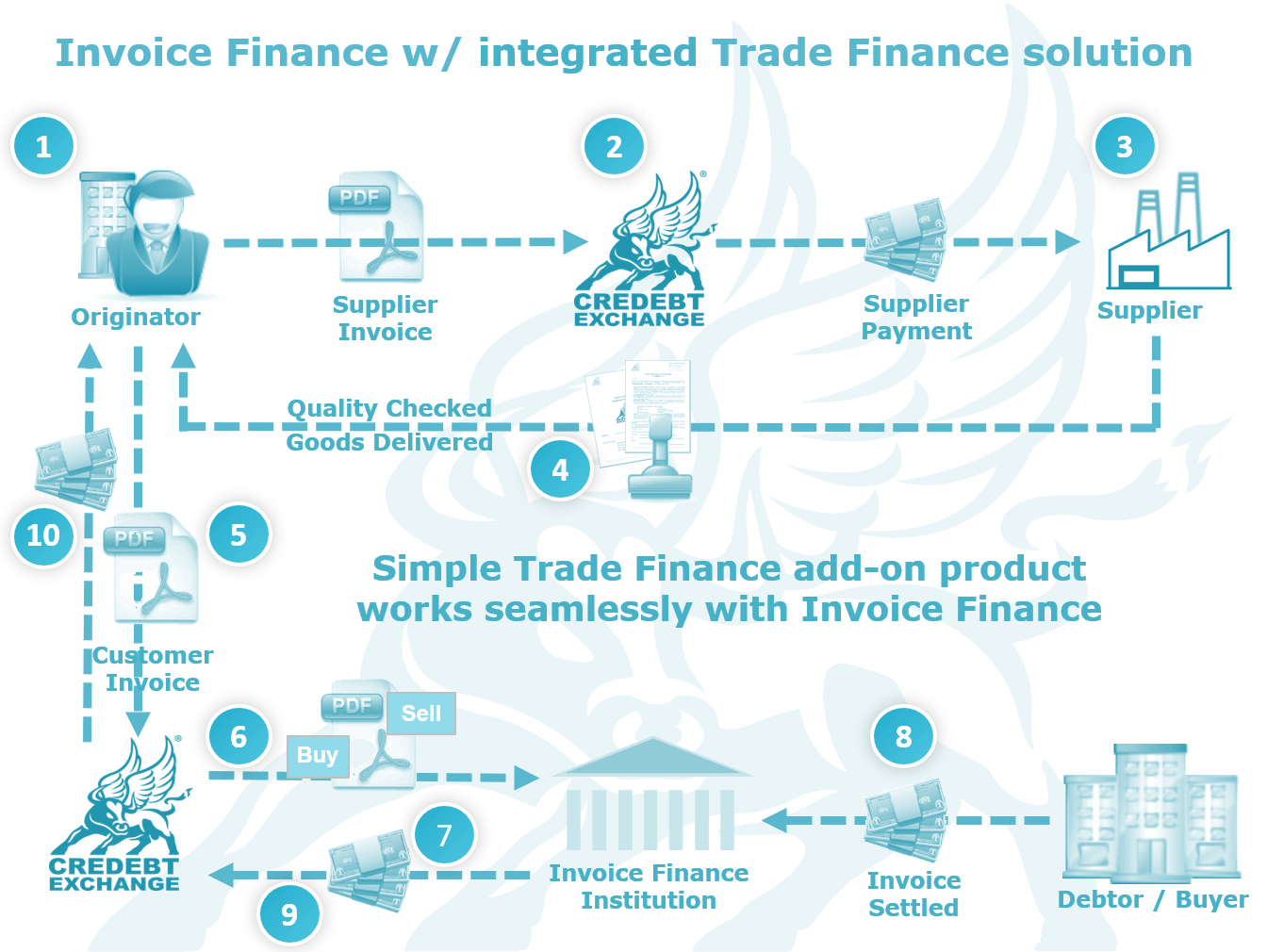

How we integrate and work with our Invoice Finance partners

Our partners are Invoice Finance specialists throughout the UK. These partners provide essential cash flow solutions to their clients by turning receivables invoices into immediate cash. Our role is to provide Trade Finance on the ‘other side’ of their clients’ businesses. Working closely with our Invoice Finance partners, Convertibill® Trade Finance provides supplier payments solutions that work seamlessly with Invoice Finance to provide one end-to-end finance solution.

Our Invoice Finance partners help their clients by reducing the strain on their credit control processes. They also enable business owners to meet overhead obligations and also to pay staff. When combined with our Trade Finance that is used to pay suppliers and to fulfil orders, a complete finance solution is achieved. As an Invoice Finance provider, adding Trade Finance is risk-free and should help boost sales of your core products. If you want a quick response you can complete this Finance Enquiry form or book a meeting now.

Let’s work together & support our clients |

|

|---|---|

| Appointment: | Book online now |

| Email: | finance@convertibill.com |

| Telephone: |

0844 774-7822 (United Kingdom) 01 685-3672 (Ireland) |

What we don’t do:

Not suited to mortgage related business or medium to long-term property deals.

What Convertibill® does:

Use client’s trade book to:- Pay suppliers enabling transport savings and bulk discounts

- Win bigger customer orders by proving financial backing is in place to fulfil larger orders

- Free up capital efficiently from cash tied up in supplier payments and ‘goods in transit’

Key aspects:

- Minimum finance requirement should be GBP 25.0k every 30 days or GBP 0.4m per annum

- No liens, personal guarantees, lock-in periods or credebt® limits apply

- Selective supplier finance and no requirement to trade all suppliers/orders