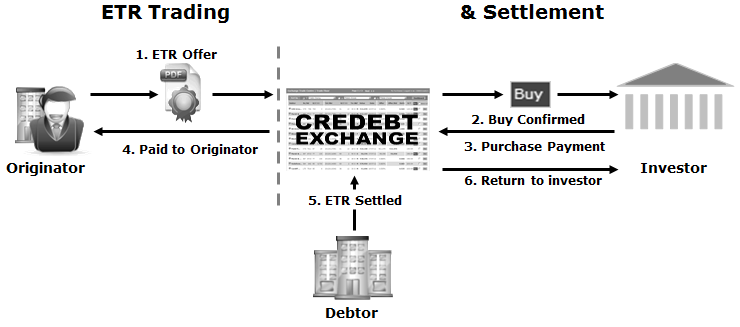

The Credebt Exchange® Master Agreement is the central, legal instrument that makes exchange trading possible. The Master Agreement is further supported by Credebt Exchange® Documents. The Master Agreement and the Credebt Exchange® Documents enable trade receivables (invoices) to be offered for sale as Exchange Traded Receivables [ETR] using the true sale, legal assignment method that features full legal assignment from the Originator to Credebt Exchange®. Every Member must first register and then complete the application process before signing the Master Agreement. The Master Agreement must be signed by every Member of the Exchange, prior to trading.

Master Agreement Concept

Master Agreement Effect

Originators

After the Originator’s Registration and application has been approved and authorised, the Originator: