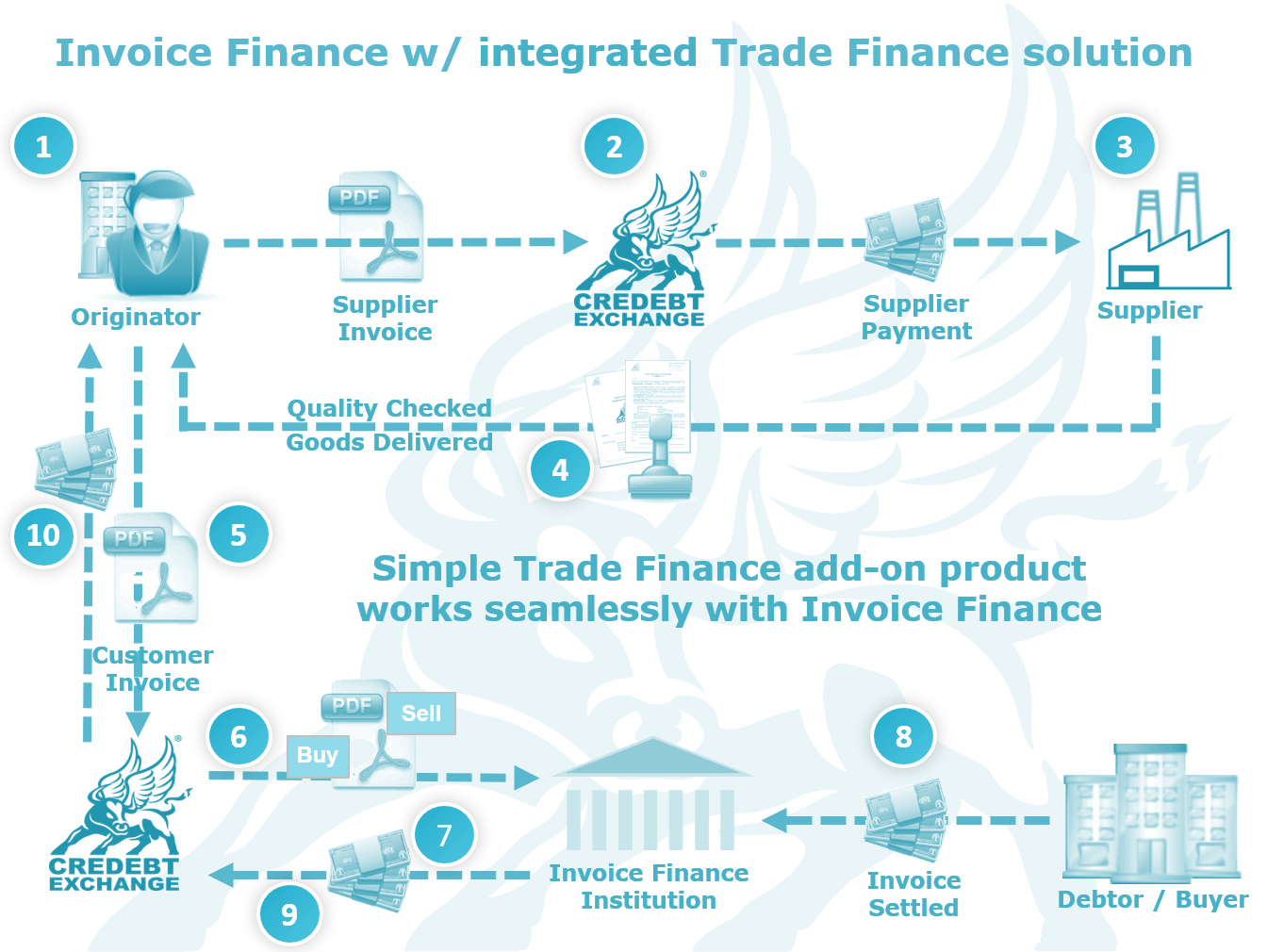

How a typical partner integration works

High-level step-by-step overview of a typical partner integration

- Your client, the Originator, sends Credebt Exchange® their supplier invoice

- Credebt Exchange® approve the invoice and makes the payment to the supplier

- The supplier receives one, or several, payment(s) and manufactures the goods

- The supplier delivers the, quality checked, goods to your client, the Originator

- Your client, the Originator, dispatches the goods and issues the customer invoice

- That invoice passes through Credebt Exchange® to your Invoice Finance system

- The Invoice Finance provider sends the 80.00% payment† to Credebt Exchange®

- The customer/buyer settles the invoice to the Invoice Finance Provider as normal

- The Invoice Finance provider sends the balance payment to Credebt Exchange®

- Credebt Exchange® instantly transfers it to your customer, the Originator

Invoice Finance Partners

Our partners are Invoice Finance specialists throughout the UK. The diagram above is a high-level schematic of a typical partner integration. Ultimately, each integration is specifically designed to be as seamless as possible without either partner being reliant on the other. This allows both organisation to operate their business ‘as usual’ without any interruption.

Starts with Open Communications

We choose to specialise in Trade Finance and enable our Invoice Finance partners to extend their overall service offerings with minimal interruption. At the heart of any great partnership is open communication. Let’s start that open communication with a conversation to explore how we can meet your requirements.

Let’s work together & support our clients |

|

|---|---|

| Appointment: | Book online now |

| Email: | finance@convertibill.com |

| Telephone: |

0844 774-7822 (United Kingdom) 01 685-3672 (Ireland) |

What we don’t do:

Not suited to mortgage related business or medium to long-term property deals.

What Convertibill® does:

Use client’s trade book to:- Pay suppliers enabling transport savings and bulk discounts

- Win bigger customer orders by proving financial backing is in place to fulfil larger orders

- Free up capital efficiently from cash tied up in supplier payments and ‘goods in transit’

Key aspects:

- Minimum finance requirement should be GBP 25.0k every 30 days or GBP 0.4m per annum

- No liens, personal guarantees, lock-in periods or credebt® limits apply

- Selective supplier finance and no requirement to trade all suppliers/orders